Financial Literacy Programs Supported by GBA

Financial abuse against older Americans can take many forms, from illegal debits, to third-party scams and even unauthorized withdrawals by an approved caregiver. Join us in our pledge to empower customers and communities with the facts, tools and best practices they need to bank more securely. Together, we can help eliminate the almost $2.9 billion lost annually to fraud against older Americans. Click the links below to learn more and register your bank to participate.

Get Details and Sign Up

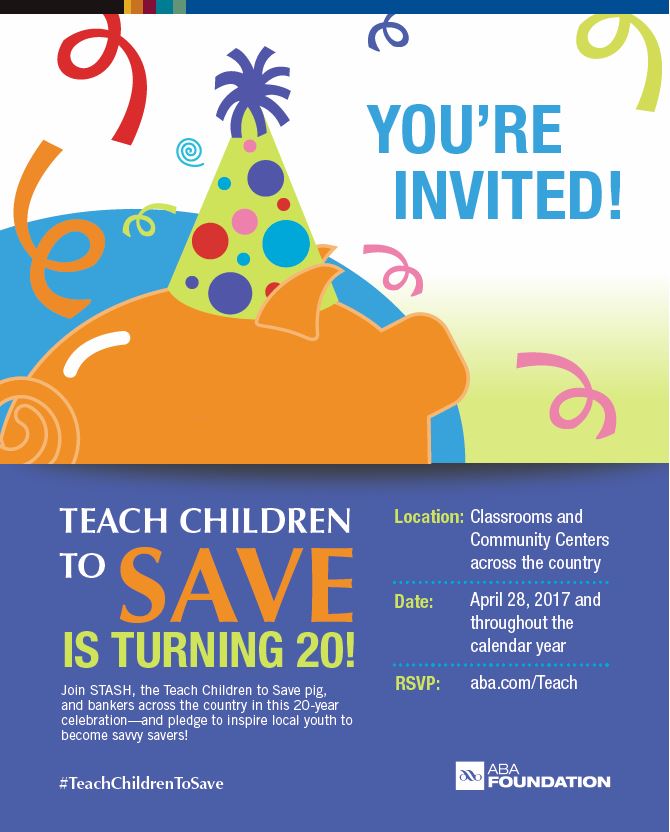

Teach Children to Save is a national program that organizes banker volunteers to help young people develop a lifelong savings habit.

Teach Children to Save is a national program that organizes banker volunteers to help young people develop a lifelong savings habit.

Get Details and Sign Up

Get Smart About Credit is a national campaign of volunteer bankers who work with young people to raise awareness about the importance of using credit wisely.

Get Smart About Credit is a national campaign of volunteer bankers who work with young people to raise awareness about the importance of using credit wisely.

Get Details and Sign Up

Lights Camera Save! is a video contest that engages teens in educating themselves and their peers about the value of saving and using money wisely.

Lights Camera Save! is a video contest that engages teens in educating themselves and their peers about the value of saving and using money wisely.

Get Details and Sign Up

#BanksNeverAskThat is a free, bold plug-and-play anti-phishing campaign designed to turn your customers into expert scam spotters.

#BanksNeverAskThat is a free, bold plug-and-play anti-phishing campaign designed to turn your customers into expert scam spotters.

Get Details and Sign Up